INSURERS IN THE FRONT LINE OF THE CLIMATE CRISIS?

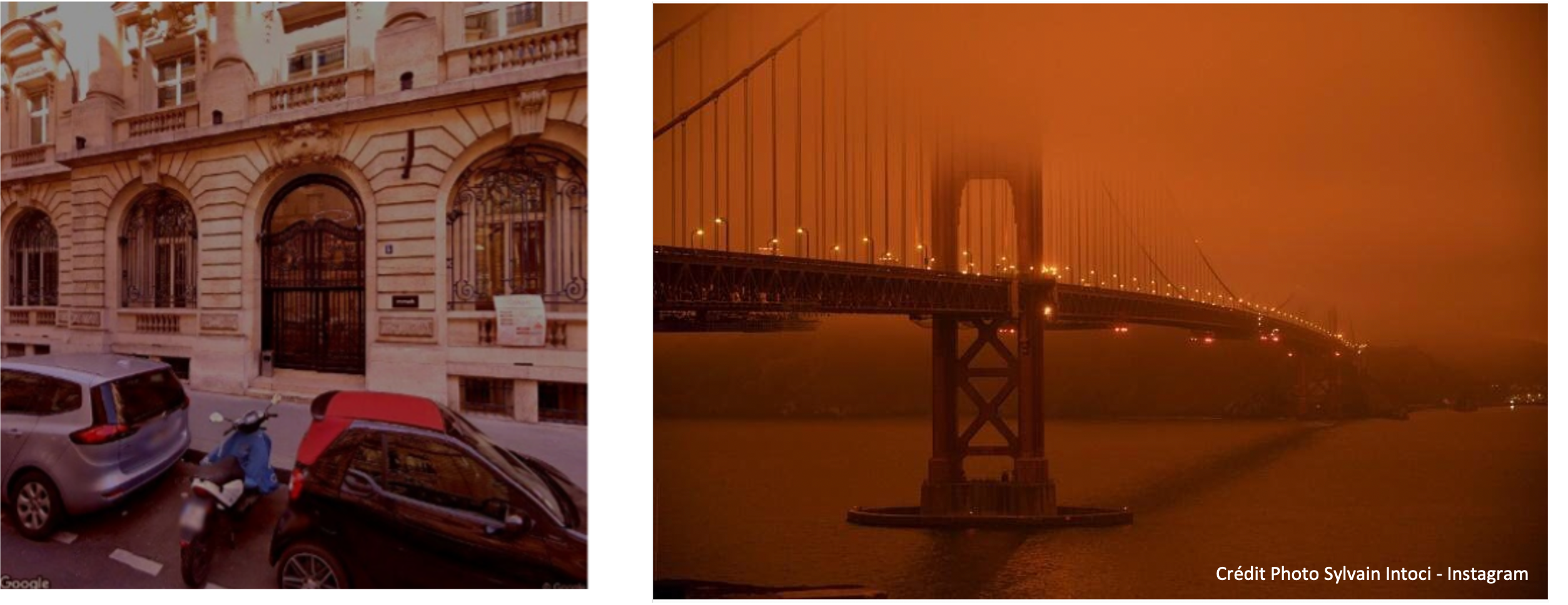

Blade Runner 2049 ? Dune?

It's misleading, yes, but none of these images are from a Denis Villeneuve movie.

The first one is what the rue Jules Lefebvre in Paris, where Equancy is located, would look like under the threat of fire and smoke clouds - this can be visualized thanks to "This Climate Does Not Exist", an AI-based experience that allows users to imagine the environmental impacts of the current climate crisis, at the address of their choice.

The second is real, it is the city of San Francisco in the summer of 2020, when California was ravaged by forest fires (photo credit: BRITTANY HOSEA-SMALL / AFP). These fires came after a record heat wave and high winds: "the worst in modern history" as the New York Times wrote.

As the speakers at COP 26, which ended two weeks ago, reminded us, we are already living with the effects of climate change. No one has forgotten the exceptional frost wave, which, in April 2021, ravaged part of the French vineyards and caused more than two billion dollars in damages to the arboriculturists, no one has forgotten the devastating fires around the world, in 2020 and 2021, for which world records of CO2 emissions have been recorded.

In his recent interview with Time, Emmanuel Faber, former CEO of Danone, said that "governments will have no choice but to look to businesses and corporations to do the work, because governments are not doing the work themselves. The private sector will be at the heart of the climate transition." Among these private actors, insurers play a central role. Often reduced to the role of post-claim payers, they are above all experts in understanding risk and see this dimension asserted in the context of the climate crisis. Back in 2015, Henri de Castries, then Chairman of AXA, explained that "a world at +2°C could still be insurable, a world at 4°C would certainly no longer be insurable". Today, we can even say that +2°C is already putting traditional insurance models at risk.

From the cost of claims to portfolio management to the product, insurance is evolving in the context of the climate crisis

In a report published in May 2021, the Autorité de contrôle prudentiel et de résolution (ACPR - responsible for overseeing the activity of banks and insurance companies in France) announced that the cost of claims in certain departments would increase by a factor of 5 to 6. Moreover, the share of the different sectors in the insurers' portfolios is changing: according to the insurer Swiss Re, the share of insurance for real estate, which is particularly vulnerable, will increase to reach 29% of the total premiums collected in 2040, compared to approximately 25% in 2020. Another sector that will be strongly impacted is agriculture. Last April, Jean Marc Jancovici reminded us of the need for agricultural insurance, while insisting on the urgent need for reinvention: "It is obviously necessary for the farmers concerned. But money can't be eaten! And insurance will be powerless to compensate for agricultural production losses if they become large due to climate change...". Finally, a reflection is also conducted on the insurance product itself: in 2018, Frans Timmermans, then vice president of the European Commission in charge of Climate proposed a bonus-malus system that would allow to lower or increase the amount of premiums according to the methods of adaptation to climate change implemented by the insured.

If paying is no longer enough, insurers are also working on risk prevention

For health prevention, the WHO states three graduated levels. Even if health risks differ from global warming risks on some dimensions, it is interesting to explore how the methodology and prevention measures put in place for the former can be replicated for the latter.

- Primary prevention - All measures aimed at avoiding or reducing the occurrence or incidence of diseases, accidents and consolidating and structuring disabilities such as psychosocial skills.

>> Parallel with the Climate - Awareness-raising actions, training on climate change, or modeling of future risks.

Indeed, training is key to accelerate the transition of companies, allowing to engage employees in this ambitious mission while increasing their skills. AXA Climate, an AXA Group entity, launched in 2021 an environmental training offering. An online learning experience designed by their science division. As of October 2021, 30,000 people have been trained, from Marsh employees to HEC students.

- Secondary prevention - An intervention that seeks to decrease the prevalence of a disease in a population, to act early in the onset of the disorder or condition to oppose its progression, or to remove risk factors.

>> Parallel with the climate - Actions aiming to reduce the environmental impact of companies, implementation of measures to reduce emissions or carbon sequestration etc. We can also find alerting services.

Allianz has developed, in partnership with Météo France, a flood and lightning risk prevention service providing all its professional and corporate clients not only with preventive alerts before climatic events but also with personalized practical advice on the measures and actions to be taken.

- Tertiary prevention - This is carried out after the disease has occurred and aims to reduce complications and the risk of relapse. It aims to reduce the effects and after-effects of a pathology or its treatment.

>> Parallel with the climate - Actions aiming at setting up adaptation measures, allowing companies to continue their activity under these new constraints.

The "adaptation measures" lever is only beginning to be exploited by insurers, but this should quickly accelerate. Their detailed understanding of risk allows them to identify the points of vulnerability of companies. This data is invaluable in identifying the adaptation measures to be put in place and can enable insurers to position themselves as key players in the ecological transition.

This article was first published by media Riskassur