André, Camaïeu then Kookaï, Go Sport, Celio, San Marina... There has been one receivership or liquidation after another in the ready-to-wear sector since September 2022.

In a changing market, the health crisis has accelerated the decline of brands that have failed to adapt their business model and define a clear commercial positioning: exploring the key factors for success.

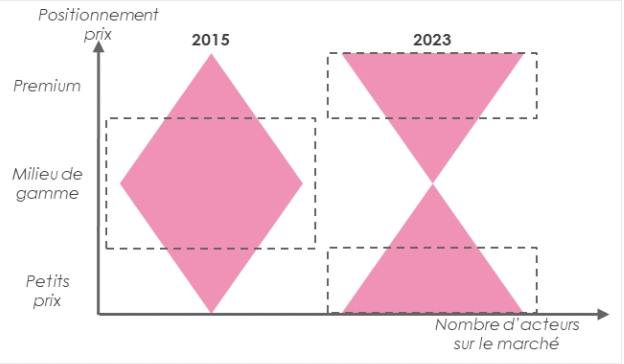

A slowing market polarised around 2 models

An image containing a line, diagram, screenshot or text

Automatically generated descriptionOver the past decade, the French clothing market has shrunk from €28.7 billion to €26 billion. The cause: new entrants - Shein, Primark, Aliexpress etc. - which are driving prices down, and exponential growth in the second-hand market (+28% by 2022).

The structure of the market is also changing: it is moving from a diamond-shaped model, with a concentration of players in the mid-range, to an hourglass model polarised around premium and low prices.

Low prices and new omnichannel concepts: the example of Kiabi

No. 3 clothing retailer in France behind Intersport and Decathlon, with 57% growth over the last decade and 560 points of contact in 23 countries: what is the recipe for Kiabi's insolent success?

The family brand is keen to put the customer at the heart of its operations. A pioneer in the field of customer knowledge, the company has set up a family observatory to decipher new uses, needs and habits. It also provides its customers with a community for exchange: advice, product tests, castings for campaigns, etc. In this way, Kiabi develops its collections for and with its customers.

Despite inflation in production and transport costs, the brand is keeping its promise of "fashion at low prices" by freezing the prices of 140 items. Despite this, it is containing the erosion of its margins by offering additional variations on existing products. It is also banking on its marketplace to strengthen its position on the web and open up to new categories such as furniture and childcare. Its ambition is to become the preferred marketplace for families.

Finally, Kiabi is continuing to evolve its model: the brand is aiming to conquer town centres, investing in the renovation of its shops and testing new omnichannel concepts. For example, the second-hand offer launched in 2020 is available online and in shops, in the form of "corners" or under the Kidkanaï banner: a shop dedicated to second-hand clothes for children. Another successful initiative is clothing hire. After a successful initiative on maternity clothes, the subscription-based hire service is being extended to all products and is being tested in a few shops.

Small volumes and strong brand identity: 2 success stories

1/ The example of Promod

"Buy less but better" is the new motto of Promod, which is reviewing its business model and moving from mass production to a precision business.

This new strategy can be seen in the creation of collections and in procurement, where new initiatives have been launched:

- Integrating the "voice of the customer" at every stage of the value chain. The brand is capitalising on its "You Make Promod" customer discussion groups to develop new models that better meet their needs.

- Reducing the number of references: by reducing the number of references by 20%, Promod has halved its unsold stock. At the same time, Promod is testing pre-order collections and producing on demand.

- Optimising supply using data: based on shopping behaviour in the catchment area. In addition, better management of its shop network will support the company's transformation: from 1,000 shops in 2016 to 418 in 2022 (down 58%).

2/ The Sézane example

Sézane has enjoyed an undeniable success story over the last few years in the French women's ready-to-wear landscape. In 2023, the queen of DNVBs will be rolling out its experience in 12 outlets. However, the brand's growth has not altered its strategy: to increase the desirability of its collections by offering successive capsule collections limited in volume and time. Sézane therefore works almost on a just-in-time basis, with very limited stocks, whose eagerly awaited restocking sets the pace for the "Sézanettes" community.

Value for money" is also at the heart of Sézane's strategy, with a clear price positioning: 70% of Sézane's range is under €200. The brand does not offer sales or promotions to maintain the perceived value of its pieces.

Buying Sézane also means living a differentiating customer experience: spotting the pieces previewed on the brand's Instagram, trying on the model in shop, ordering the model on the website to make up for the very limited stocks in shop. It's an omnichannel experience that allows the brand to differentiate itself and strengthen its brand image.

The big winners in the ready-to-wear sector are succeeding thanks to a clear price positioning for the customer without compromising on style, control of supply costs through data and customer focus, and innovations for a seamless omnichannel experience.